Understanding and managing the financial impact of climate and ESG risks, pivoting to the post-pandemic economy with higher interest rates and inflation, adapting to rapidly changing technologies - these are just some of the topics keeping credit professionals up at night.

Join us Thursday, June 3, 2021 to hear from Moody’s Analytics experts and industry leaders about new approaches to successfully dealing with these challenges.

This event will offer participants an opportunity to:

- Hear from the Predictive Analytics leadership team about their vision for the next generation of risk scoring solutions.

- Learn from industry experts as they share their insights into post-pandemic trends in portfolio and risk management.

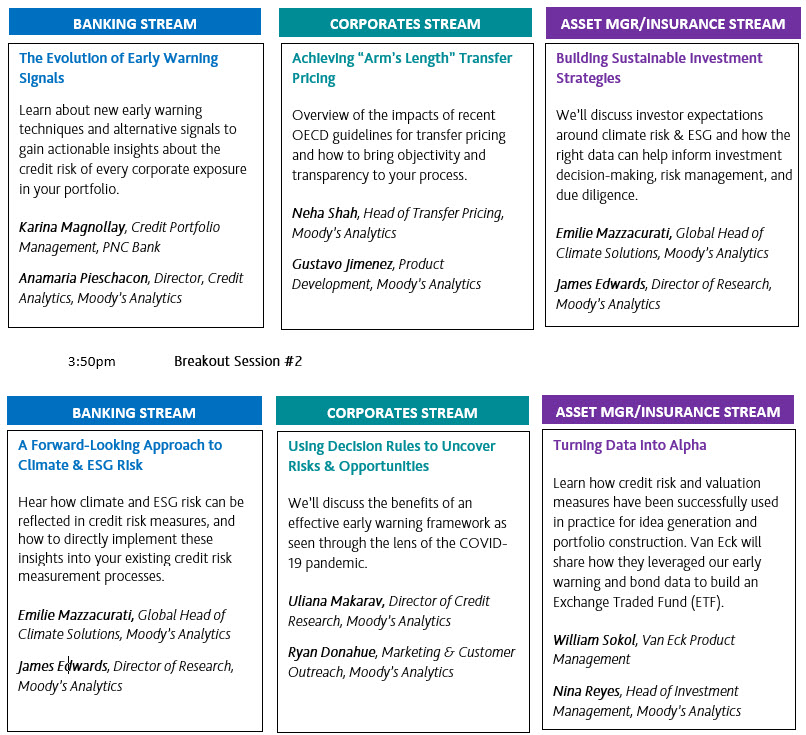

- Engage with your peers during sessions tailored for Banks, Corporates and Asset Managers/Insurers.

- Dive into topics such as leveraging AI, alternative data and early warning decision rules in your risk management process, assessing the impacts of new regulations on transfer pricing, and incorporating climate and ESG factors into credit risk models and investment processes.

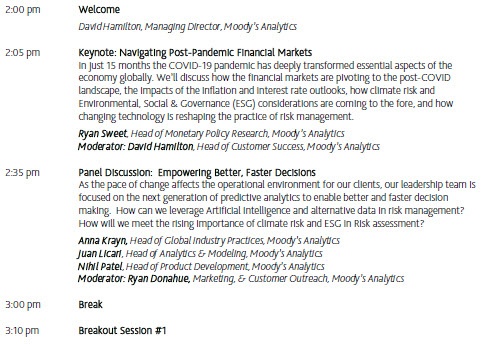

AGENDA